Adverse Auditing

Adverse Auditing & Risk Review

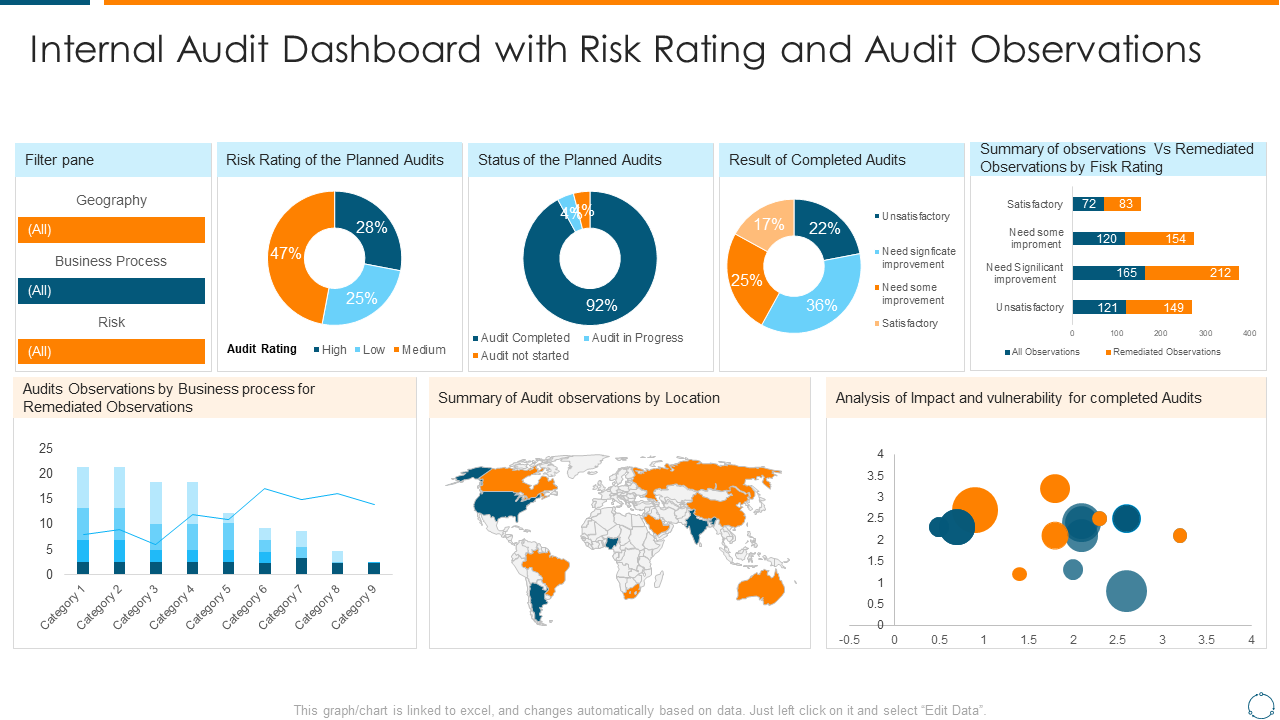

SSBPO provides structured adverse auditing services to identify operational risks, data inconsistencies, and compliance gaps across business processes. Our auditors review large datasets, system logs, call records, and transactional data to detect anomalies and errors. We help organizations improve accuracy, mitigate risks, and maintain operational integrity. Each audit follows documented methodologies and quality checkpoints. Our reports support informed decision-making and regulatory confidence.

Transaction Review Audits

Detailed audits of operational and financial transactions to identify errors, anomalies, and risk patterns.

Process Compliance Audits

Evaluation of workflows to ensure adherence to internal policies, SLAs, and regulatory requirements.

Data Integrity Audits

Verification of data accuracy, completeness, and consistency across systems and reports.

Operational Risk Assessment

Identification of process weaknesses that may lead to financial loss or compliance issues.

Exception & Error Analysis

Root-cause analysis of recurring errors to reduce future operational failures.

Audit Reporting & Documentation

Structured audit reports with findings, risk levels, and corrective recommendations.

Identify Risks Before They Become Losses

SSBPO’s Adverse Auditing service is designed to identify risks, discrepancies, and operational weaknesses before they become costly problems. Our audit specialists conduct in-depth reviews of financial records, workflows, and compliance standards to uncover gaps, irregularities, and exposure points. We follow structured audit frameworks combined with real-world business insight to ensure accuracy and transparency. By proactively detecting adverse issues, we help organizations reduce losses, strengthen controls, and maintain regulatory confidence. Our audits deliver clear findings, actionable recommendations, and measurable risk reduction.